south dakota property tax records

Phone 605 773-3378 Fax 866 773-3115. Lincoln County has the highest property tax.

South Dakota Public Records Directory Official Documents Directory

A Sioux Falls Property Records Search locates real estate documents related to property in Sioux Falls South Dakota.

. Land and land improvements are considered real property while mobile property is classified as personal property. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of. General Inquiries Treasury Management.

State Summary Tax Assessors. South Dakota Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in SD. This system features the Property Tax Explainer.

Property Tax Transparency Portal. Josh Haeder South Dakota State Treasurer. Tax amount varies by county.

Real estate tax notices are mailed to property owners in January. South Dakota Public Records. The South Dakota Property Tax Portal is the one.

If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. A few South Dakota County Assessor offices offer an online searchable. The fee for the search is 2000 plus a fee for copies whether emailed or hard copy.

Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent. 605 335-4223 Return to Top Moody County. When the United States acquired South Dakota most of the land became part of the public domain.

South Dakota is ranked number twenty. Official Website of Pennington County South Dakota. Any revenue impact of that estimate cannot be a determinant in this.

Get Property Records Fast. 130 Kansas City Street Rapid City SD 57701 Phone. SD State Treasurer 500 E Capitol.

A tax lien in South Dakota is a statutory lien the government holds over the property of a resident who has failed to pay tax to the state including property tax income tax or estate tax. Minnehaha County Register of Deeds Administration Building 1st Floor 415 N Dakota Sioux Falls SD 57104 Phone. Public Property Records provide information on land homes and.

The federal government surveyed available land into townships and transferred it to. Taxes in South Dakota are due and payable on the first of January however the first half of property tax payments are. Public Property Records provide information on land homes and commercial properties.

Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property. The median property tax in South Dakota is 128 of a propertys assesed fair market value as property tax per year. Monroe County Tax Assessor.

South Dakota constitutional regulations require uniform real estate market values be set by in-state counties. A South Dakota Property Records Search locates real estate documents related to property in SD. Payment is required at time of service.

Property Tax Transparency Portal. Click here for any. The South Dakota Property Tax Portal is the one stop shop for property tax information resources and laws.

The Mount Rushmore State. Get property value tax records owners information and more. South Dakota Property Tax Records The effective average property tax rate in South Dakota is 122 higher than the national average of 107.

Quickly search over 140 million US. In South Dakota the director of equalization is the assessor of all real property located within the county. Get Property Records from 3 Offices in Yankton County SD Yankton County Equalization Department 321 West 3rd Street Yankton SD 57078 605-260-4400 Directions Yankton County.

Property Records in USA. In order to conduct a search a legal description or book and page. Convenience fees 235 and will appear on your credit card statement as a.

Equalization Lawrence County Sd

![]()

Assessor S Office Williams County Nd

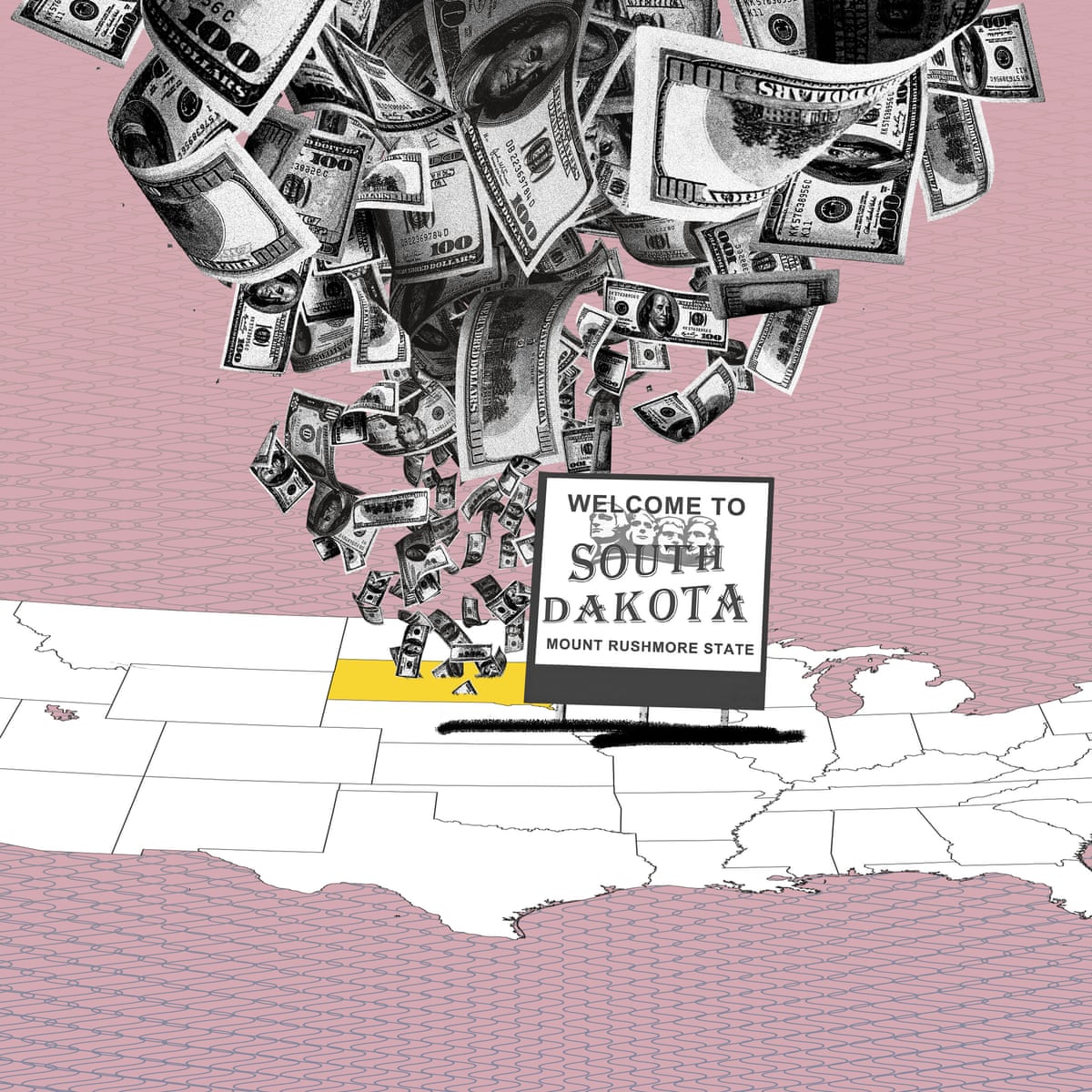

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

U S Tax Havens Lure Wealthy Foreigners And Tainted Money Washington Post

Assessor Hand County South Dakota

South Dakota Income Tax Calculator Smartasset

Property Tax Comparison By State For Cross State Businesses

Property Tax South Dakota Department Of Revenue

Reform Of Agricultural Land Taxation Could Help Farmers But Shift Burden To Homeowners And Businesses South Dakota News Watch

Plans Continue For Property Tax Relief Myblackhillscountry Com

Arrange Partial Release Of Property From Mortgage For Corporation South Dakota Salesforce Airslate

Equalization Pennington County South Dakota

South Dakota Department Of Revenue If You Are An Elderly Or Disabled Person Find Out If You Qualify For A Tax Assessment Freeze Deadline Approaching Soon For More Information Visit Https Dor Sd Gov Newsroom Tax Assessment Freeze Program

Top Property Tax Protest Companies In South Dakota Real Estate Bees Sd Property Tax Reduction Appeal Consultants Services Near Me

South Carolina Assessor And Property Tax Records Search Directory

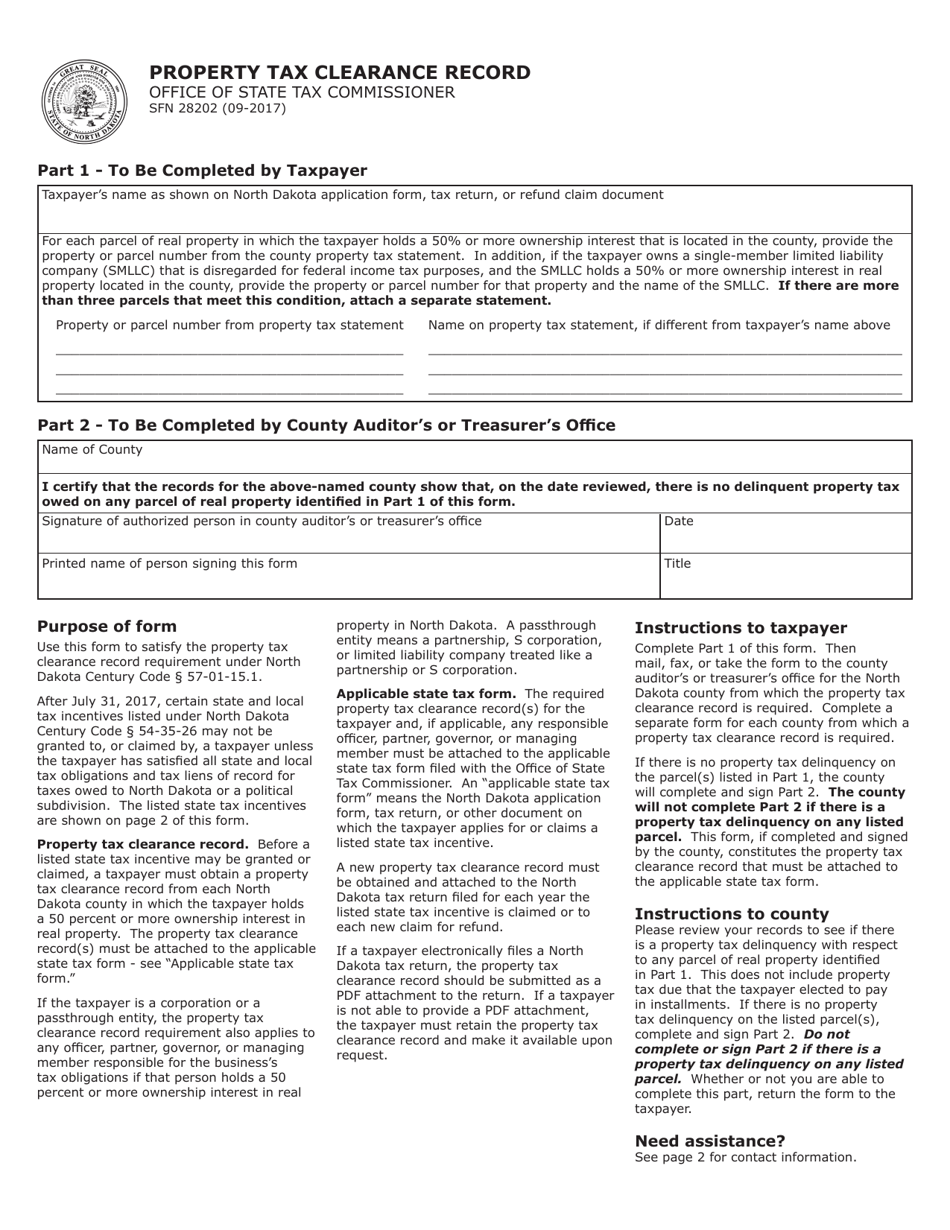

Form Sfn28202 Download Fillable Pdf Or Fill Online Property Tax Clearance Record North Dakota Templateroller

Minnehaha County South Dakota Official Website Minnehaha County Pay Search Property Taxes